Ever wondered if you could turn your obsession with Schitt's Creek into a legit tax write-off? Well, buckle up, because we're about to dive deep into the world of taxes, TV shows, and everything in between. If you're a fan of this iconic series, you might be surprised to learn just how much of it can actually translate into tax benefits. Whether you're a small business owner, a freelancer, or someone who simply loves binge-watching, this guide has got you covered.

Let's face it, taxes can be confusing, but they don't have to be. Imagine being able to claim expenses related to your favorite TV show as legitimate deductions. Sounds too good to be true? Not really. With the right approach and some insider tips, you can absolutely make Schitt's Creek work for you when tax season rolls around.

Now, before we get into the nitty-gritty, let's address the elephant in the room. Not everyone will qualify for these deductions, but if you're creative, resourceful, and willing to put in the effort, there's a good chance you can find a way to make it happen. Stick around, and we'll break it all down for you.

Read also:How To Pull Down Blinds With 3 Strings A Stepbystep Guide Yoursquoll Actually Use

What is Schitt's Creek Tax Write Off?

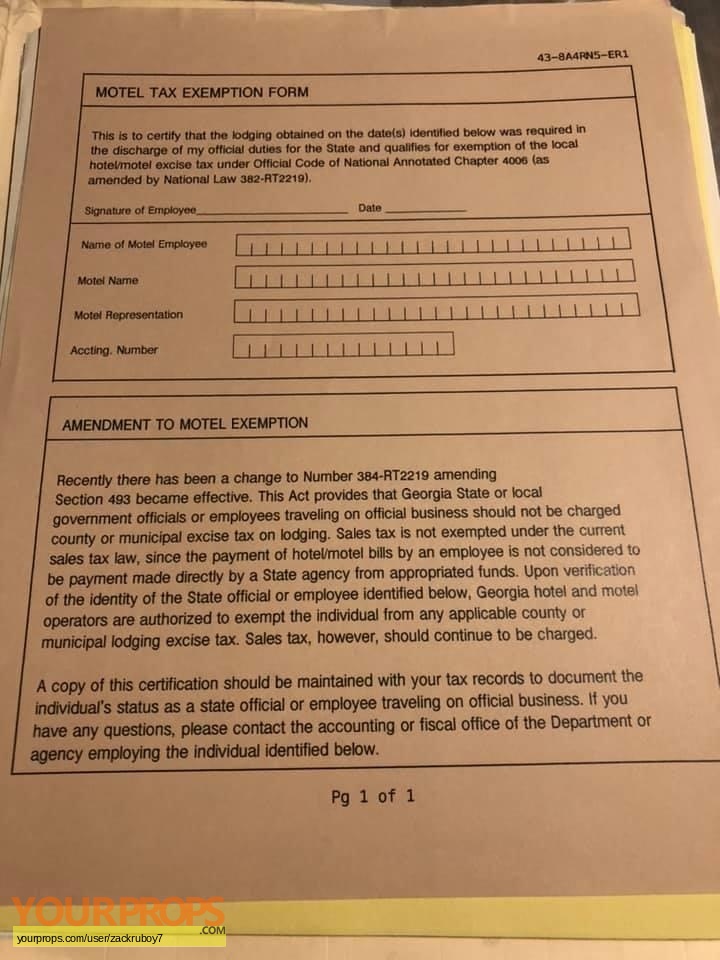

First things first, let's define what we're talking about here. A Schitt's Creek tax write-off refers to any expense related to the show that can be legally deducted from your taxable income. This could include anything from streaming services to merchandise purchases, travel expenses, or even business-related costs. The key is proving that these expenses are necessary for your work or income-generating activities.

For example, if you're a content creator who regularly discusses Schitt's Creek on your blog or YouTube channel, you might be able to claim expenses related to watching the show as part of your research. Similarly, if you're a small business owner who uses the show as inspiration for marketing campaigns, those costs could also qualify as deductions.

Why is Schitt's Creek Relevant for Tax Purposes?

Schitt's Creek has become more than just a TV show; it's a cultural phenomenon. With its quirky characters, witty dialogue, and heartwarming storyline, it's no surprise that fans are finding ways to incorporate it into their daily lives. But what makes it particularly relevant for tax purposes is its widespread appeal and versatility.

Whether you're a writer, marketer, or entrepreneur, Schitt's Creek offers endless opportunities for inspiration and creativity. From its unique branding to its relatable themes, the show provides plenty of material to work with. And when you're using it as part of your professional endeavors, those expenses suddenly become tax-deductible.

How to Claim Schitt's Creek Expenses

Claiming expenses related to Schitt's Creek isn't as straightforward as simply writing down "TV show" on your tax return. You'll need to provide documentation and justification for each deduction. Here's a step-by-step guide to help you navigate the process:

- Keep detailed records of all expenses related to Schitt's Creek.

- Document how these expenses directly contribute to your income-generating activities.

- Consult with a tax professional to ensure you're following all applicable laws and regulations.

- Be prepared to justify your deductions in case of an audit.

Common Schitt's Creek Tax Deductions

So, what exactly can you deduct when it comes to Schitt's Creek? Here are some common examples:

Read also:Elliot Cadeau Hair The Ultimate Guide To A Trendsetting Hairstyle

Streaming Services

If you're using a streaming service like Netflix to watch Schitt's Creek, you might be able to claim part of your subscription fee as a business expense. Just make sure you're using the service primarily for work-related purposes.

Merchandise

Buying Schitt's Creek merchandise? If it's for promotional purposes or as part of a business-related activity, you might be able to deduct those costs. Think of it as branding for your business.

Travel Expenses

Attending a Schitt's Creek fan convention or visiting filming locations? If it's tied to your business or profession, those travel expenses could qualify as deductions.

Understanding the Legalities

Before you start claiming every Schitt's Creek-related expense under the sun, it's important to understand the legalities involved. The IRS has strict guidelines when it comes to deductions, and failing to comply can result in penalties or audits. Here are some key points to keep in mind:

- Ensure all expenses are ordinary and necessary for your business.

- Keep detailed records and receipts for all deductions.

- Consult with a tax advisor to ensure compliance with local and federal laws.

Expert Tips for Maximizing Deductions

Want to get the most out of your Schitt's Creek tax write-off? Here are a few expert tips to help you maximize your deductions:

Track Everything

Use accounting software or a spreadsheet to track all expenses related to Schitt's Creek. This will make it easier to calculate your deductions and provide documentation if needed.

Stay Organized

Organize your receipts and invoices in a way that makes sense for your business. This will save you time and hassle when tax season rolls around.

Be Honest

Don't try to claim personal expenses as business deductions. The IRS takes a dim view of this, and it could land you in hot water.

Real-Life Examples of Schitt's Creek Tax Write-Offs

Curious to see how others have successfully claimed Schitt's Creek-related expenses? Here are a few real-life examples:

Content Creators

A popular YouTuber who creates video essays about Schitt's Creek regularly claims expenses related to watching the show as part of their research. They also deduct costs associated with filming and editing their videos.

Marketers

A marketing agency that uses Schitt's Creek themes in their campaigns deducts expenses related to brainstorming sessions, creative materials, and promotional activities.

Entrepreneurs

A small business owner who sells Schitt's Creek-themed products deducts costs related to product development, marketing, and shipping.

Common Mistakes to Avoid

While claiming Schitt's Creek expenses can be a great way to save money on taxes, there are a few common mistakes to avoid:

- Not keeping proper documentation.

- Claiming personal expenses as business deductions.

- Failing to consult with a tax professional.

Conclusion

In conclusion, turning your love for Schitt's Creek into a tax write-off is not only possible but can also be a great way to save money on taxes. By understanding the rules, keeping detailed records, and consulting with a tax professional, you can maximize your deductions and make the most of your favorite show.

So, what are you waiting for? Start documenting those expenses and get ready to enjoy some serious tax savings. And don't forget to share this article with your fellow Schitt's Creek fans. Together, we can turn our passion for the show into financial benefits!

Table of Contents

- What is Schitt's Creek Tax Write Off?

- Why is Schitt's Creek Relevant for Tax Purposes?

- How to Claim Schitt's Creek Expenses

- Common Schitt's Creek Tax Deductions

- Understanding the Legalities

- Expert Tips for Maximizing Deductions

- Real-Life Examples of Schitt's Creek Tax Write-Offs

- Common Mistakes to Avoid

- Conclusion